Paynt – payment solutions in an on-demand world

The world of payment solutions is ever-changing and if anything, it’s only getting more complex.

In 2019, 708 billion payments were cashless. These not only include card payments, but also a variety of alternatives, such as:

- money transfer and payment services (eg., PayPal)

- virtual wallets (such as Apple Pay or Google Wallet)

- mobile payment systems (eg., Braintree, Stripe)

- and more.

In such a world, businesses that are able to offer their clients a variety of payment options, are the ones to win more customers. Because the stats are clear: people, especially younger generations, prefer online stores and services that allow them to pay with their most convenient payment method. And there are as many preferences as there are people.

This has created new challenges for payment acquirers and resellers. Businesses today require payment solutions that allow them to serve customers worldwide and adjust to their diverse needs and preferences. If a payment solution is unable to deliver this, it can seriously affect the business’ bottom line. This has put pressure on payment acquirers and resellers that now need to provide their clients with as many options for payment processing as possible.

The reality, however, is that resellers currently lag behind when it comes to meeting these market demands. Their onboarding is complex and slow, whereas their reporting systems are not up to par with what users expect – they’re expensive to maintain, outdated, and lack transparency, leaving users confused about how their business is doing.

This is about to change – meet Paynt, the new player in the world of online payment systems.

Since 2015, Paynt has been aiming to transform card and online payment acquisition by building advanced technological payment solutions, slashing costs, and saving time for its users and partners. All that while boosting efficiency and customer experience.

Paynt is challenging the status quo and focuses on three qualities:

- Transparency

- Efficiency

- Responsiveness

Let’s take a closer look at each of them.

Transparency

The Paynt solution ensures unprecedented transparency when it comes to onboarding and reporting.

Merchant onboarding with Paynt

Before Paynt, the process of merchant onboarding was riddled with inefficiencies and lack of transparency – the process was long, included a number of unnecessary steps, and didn’t provide merchants with any status updates along the way. Basically, once you’ve submitted your application, all you can do is sit and wait, and hope for a positive reply.

Paynt has solved this by providing its users – such as Independent Sales Organisations (ISOs) – a platform and onboarding tools that give the clarity and transparency their clients want. This allows them to attract more clients and boost their revenue.

Reporting with Paynt

Life’s much easier when you know where you stand – this is especially true when you’re running a business. As a business owner, you need to know how you’re performing, which clients are the most profitable, and more. This allows you to analyze your results and adjust your actions as needed.

What happens if reporting is incomplete or even nonexistent? That leaves you in the dark and can seriously damage your business.

Paynt brings together integrated reporting along with real-time insights, allowing resellers to know precisely where they stand and how their business is doing. They can follow the performance of their merchants, generate insightful reports and act accordingly.

Efficiency

For years, payment acquirers have been running a race to the bottom. The lower the price they’d offer to merchants, the higher would be the chances to attract and retain customers. But nowadays, increasingly more merchants value efficiency over price.

A lower acquiring fee won’t help much if the payment solution is cumbersome and requires a lot of involvement, both when setting it up and during daily use.

Paynt has developed an internal system that allows us to take care of some of the most cumbersome tasks for you, leaving you more time to focus on the things that matter for your business.

For example, we’ve built a smart, frictionless, rule-based application and KYC process that automatically performs a significant amount of underwriting tasks via external integrations. This saves hours and requires significantly less involvement from the client being onboarded.

Responsiveness

Being able to reply to your merchants quickly and timely is one of the biggest struggles of ISOs that usually manage up to a few hundred accounts at the same time. For merchants, this can be a deal-breaker – they want their payment processing partners to be accessible, transparent, and responsive.

For this reason, Paynt has built a solution for merchants that they can access to gain the insights they’re looking for. They can have a 360-degree view of every transaction, deposit reporting, and statement history. It’s available 24/7 and is the place for merchants to track their business performance.

With these stats always at hand, merchants won’t need to reach out to their ISOs as often anymore. And with their inboxes emptier, ISOs will have more time to answer incoming questions and requests faster.

Paynt has got you covered

The world of commerce has changed dramatically, and ISOs and ISVs need to keep up with the times and growing requests from their clients.

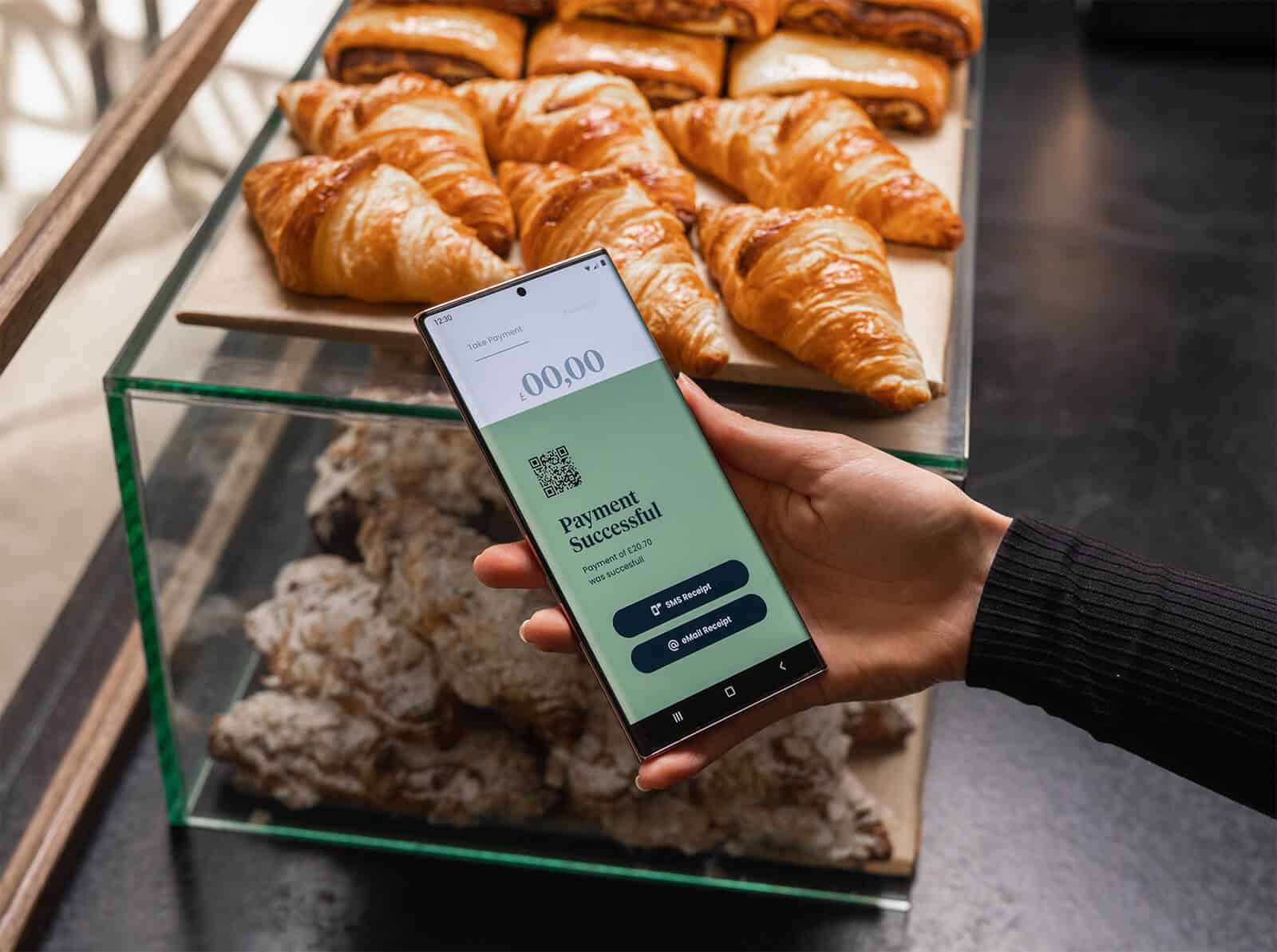

Paynt makes this easy. It allows you to offer your customers the largest number of online and offline payment processing options while giving you access to a highly advanced back-end platform that helps you serve your customers in a transparent, effective, and responsive way.

Want to learn more? Reach out to us now!