Paynt stands for Payments As You Need Them. Our robust payment infrastructure platform is built for merchants and partners to access an extensive range of payment capabilities that work seamlessly across multiple channels, locations and devices.

Whether you’re looking for secure payment solutions, exploring new sales channels or expanding into new markets -

Paynt has a payment solution for you!

All-in-One Payments

Connect with Your Customers Wherever They Are

Paynt’s wide range of payment products lets businesses of all sizes accept payments: whether it is in-person, over the phone, online or on a mobile app. Through a variety of APIs, our payment solutions can be quickly and easily integrated with any existing products/services provided by our customers.

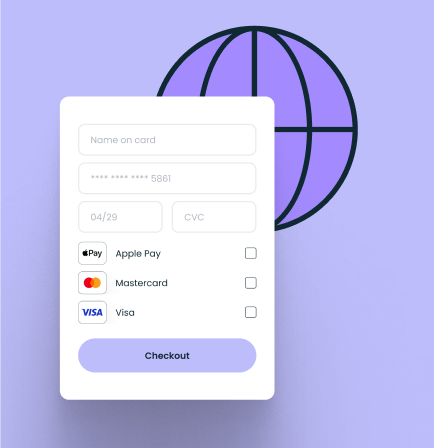

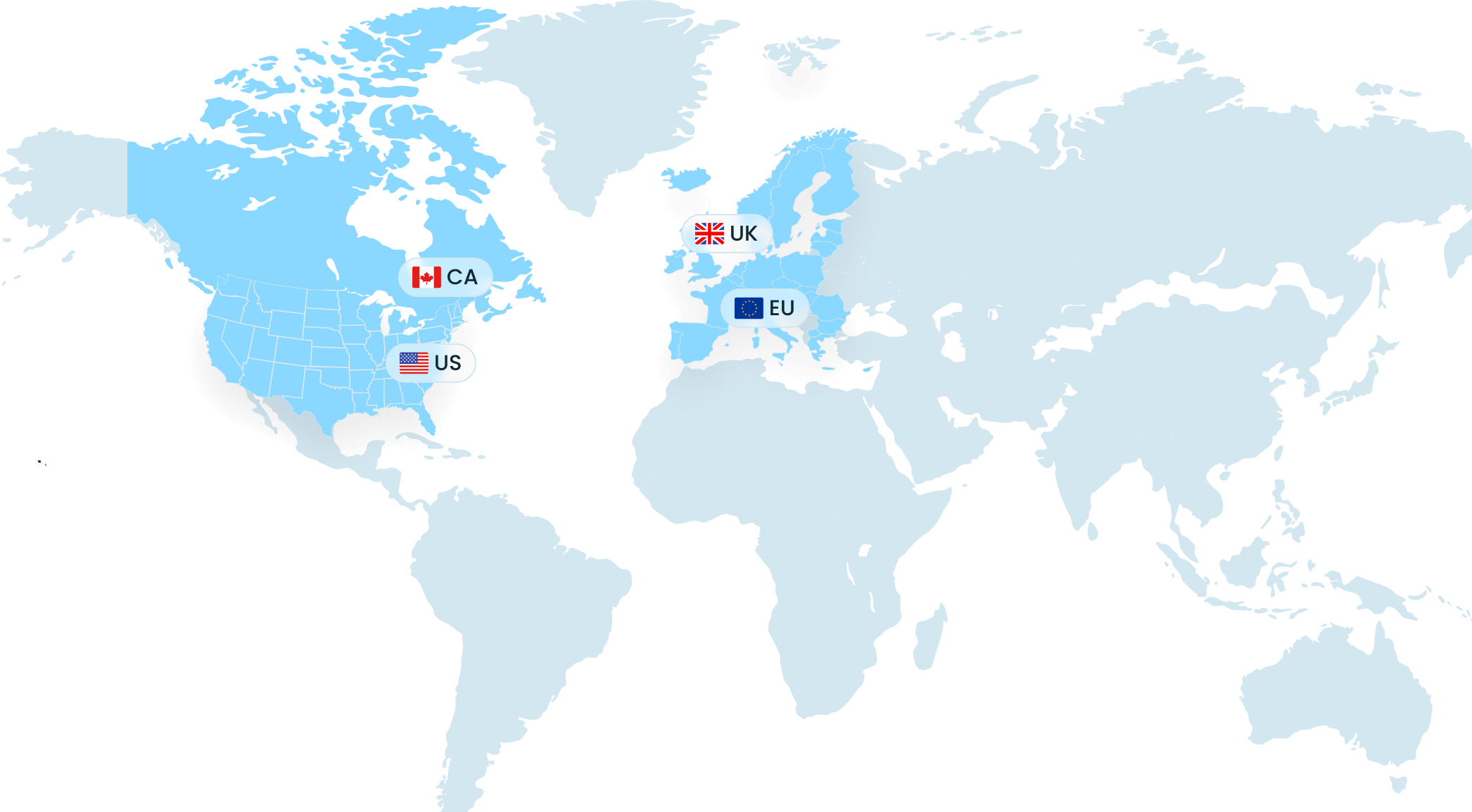

Unlock New Markets

Expand Your Business with Our Wide Acquiring Network

Paynt’s wide global footprint for its acquiring services across Europe and USA means we're able to help your business to enter new markets quickly without worrying about finding local acquirers or regulatory compliance. We offer our customers access to an extensive worldwide network of card schemes and popular payment methods, enabling multi-channel payment capabilities across these new markets.

Acquiring Countries

Payment Processing Countries

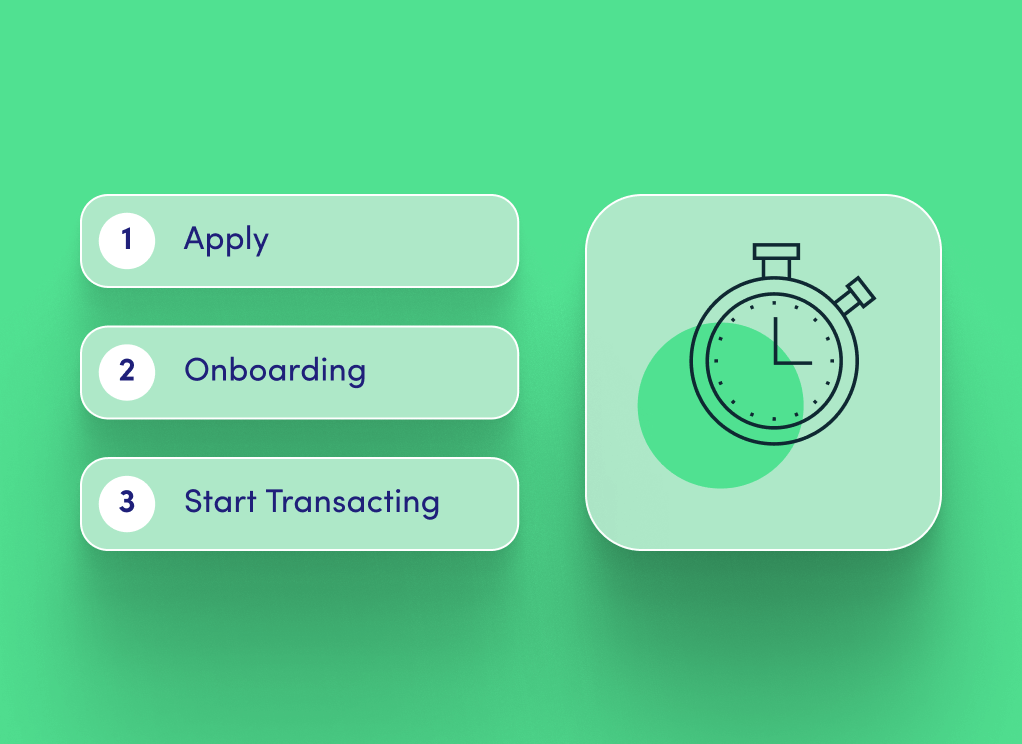

Rapid Onboarding

Start Transacting Within 24 Hours

In our business, time is literally money, when it comes to activating your payment services. Paynt Portal, our proprietary platform offers an automated, rule-based onboarding activation to get merchants transacting in a matter of few hours*. Our Partner Support team is available to help guide you through the onboarding process.

Centralised Reporting

Track Performance Across All Your Payment Channels

Using an multi-channel payment services provider like Paynt gives you access to a single dashboard view at all your payment channels. A singular view of all your key performance metrics and transaction data on the Paynt Portal allows you to:

-

Track revenue and cashflow easily

-

Make better informed financial projections

-

Improve payment efficiency

-

Spot spend patterns across your sales channels

-

Analyse seasonal trends

Complete Payment Security

Robust Measures for Secure Transactions

Paynt follows the strictest protocols in the payments industry and offers secure payment solutions that protect your business, safeguard customer financial data, comply with local regulations, and ensure financial integrity.

Empowering Growth

Get the Resources You Need to Thrive

As a full-service payment services provider, Paynt supports merchants and partners with a range of flexible and cost-effective solutions that improve their operations, help scale efficiently and empower financial growth.

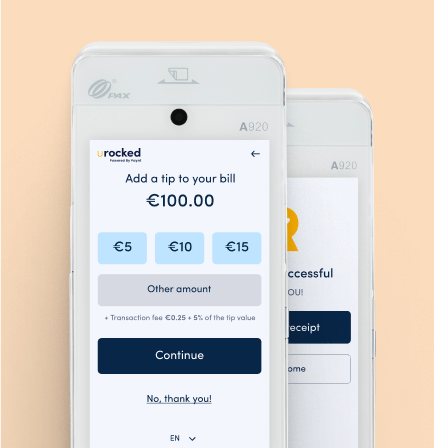

Speed Up Success with Paynt Funding

Whether you are dealing with sudden repair costs or need an urgent restock, because your product went viral on TikTok, small businesses often face challenges that require creative financial solutions. With Paynt, our merchants can access flexible funding or cash advances through the Paynt Portal to deal with unexpected expenses. You can unlock funds up to 2x your monthly revenues via Paynt Portal at affordable rates and easy repayment plans; and keep growing your business.

Go to Paynt FundingFree Up Capital Costs with Flexible Terminal Financing

Paynt merchants can free up capital and improve cashflow when upgrading their POS terminals with Paynt. With flexible financing options, merchants can avoid large upfront costs when getting set up. Free up capital, reduce financial burden so you can focus on growing from day one.

Dedicated Support

We're Here to Help Your Business Succeed

Payments are a critical part of any business, and our dedicated support team recognise that. We’re here to make your payments work for you!

Customer and Technical Support

Reach out to our friendly customer support team in Latvia and the United Kingdom via phone, email or through Paynt Portal or Member app to resolve any queries (Monday to Friday, 7AM to 5PM GMT)

Help Centre

Access a 24/7 AI-powered Self-Service Assistant via Paynt Portal. Our knowledge base has a collection of helpful articles, troubleshooting guides and plenty of resources that you may need.

Partner Support

Our dedicated partner support team improves the merchant application process, speeds up onboarding and ensures a commercially successful partnership.

Start Accepting Payments with Paynt

Contact Us