Author: Egle Andzeviciute, CAMS, CGSS – Chief Compliance Officer, MLRO, Paynt

With the rapid growth of the FinTech industry, regulatory oversight has become increasingly important.

Lithuania has not only positioned itself as the leading hub for financial innovation, with a thriving ecosystem of companies and start-ups, but has also implemented significant changes in the regulatory environment.

Paynt has been operating under Lithuanian jurisdiction for over six years and was among the first to obtain an EMI license (No.2) from the Bank of Lithuania. We have witnessed this evolution and have remained at the forefront of compliance throughout.

We asked our Chief Compliance Officer and MLRO, Egle Andzeviciute, to share valuable insights on the changes and what they mean for our industry.

The Rise of Lithuania’s FinTech Ecosystem

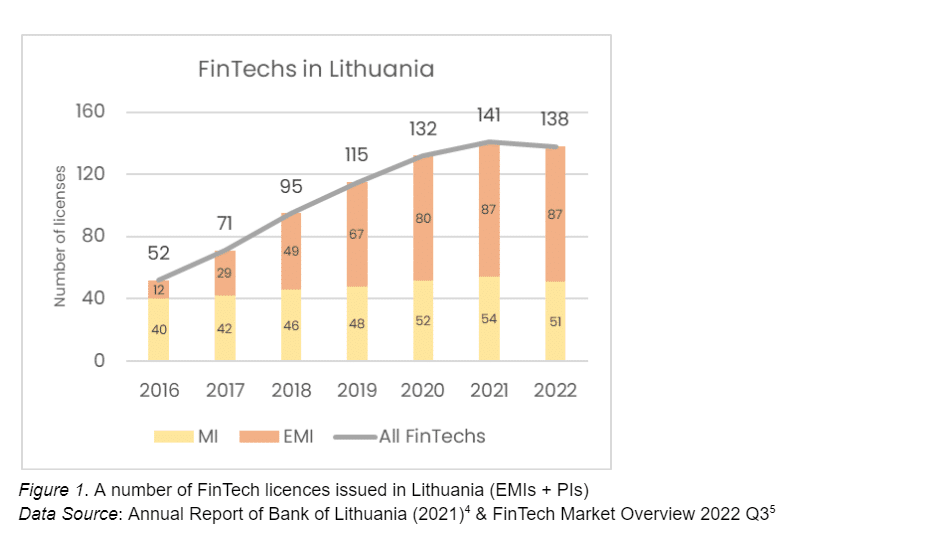

In recent years Lithuania has become the new FinTech hub of the European Union. According to TheBanks.EU (*1), in the EU there are 272 registered Electronic Money Institutions (EMIs) out of which nearly one-third are registered in Lithuania. In recent years growth of Payment Institution (PI) issued licenses have been observed too. According to the Overview of activities of EMIs and PIs (2022 Q3) issued by the Bank of Lithuania (*2), in total there are 138 FinTech licenses granted (87 EMIs and 51 PIs) by the Lithuanian regulator.

The most rapid expansion of the Lithuanian FinTech sector was seen during 2016-2020, which then stabilized over the last two years (see Figure 1). According to the Fintech Landscape Report 2021-2022 (*3) issued by Invest Lithuania, FinTech businesses choose Lithuania mainly because its regulatory environment and infrastructure is FinTech-friendly (81% of respondents indicated this reason). Also, Invest Lithuania Fintech Survey Results (2021) show that 88% of respondents had a positive experience with the local regulator – the Bank of Lithuania.

Riding the Wave of Change

The Lithuanian FinTech era growth during 2016-2020 marks other important EU policy timelines: on the 23rd of June, 2016 the United Kingdom citizens voted to leave the European Union and on the 31st of January, 2020 at midnight (CET) Brexit entered into force (The UK is no longer an EU member state and is considered a third country by the European Union) (*6).

Following the UK withdrawal agreement, European Banking Authority clarified the Brexit transition period matters (2020) (*7) which explains that a segment of the EU-resident client base of the UK-based financial institutions had to be transferred to the institutions that are licensed within a member state. Otherwise, UK-based institutions without EU-granted authorization will lose the right to provide financial services within the EU.

Taking into account the supranational political circumstances, it is clear that Lithuania successfully employed the opportunity of Brexit and started to build up its own financial centre within the EU.

Improving the Regulatory Landscape

Lithuania as a pioneering country and home to hundreds of FinTech companies had to react and mature fast, especially with adopting laws and regulations to the changing environment and new risks.

It was evident that over time, the number of applicable regulations, resolutions, decisions, rules, guidelines and recommendations issued by the Bank of Lithuania rose significantly. In the beginning, the regulator’s attention was focused mainly on money laundering and prevention of terrorist financing, safeguarding of client funds and capital adequacy compliance. However, in recent years, it rapidly expanded to other equally important topics such as governance, internal controls, risk management and ICT, and security risk management. The change in focus is also evident in the Inspection Plans of Financial Market Participants (*8) that the Bank of Lithuania is issuing each year. The new focus areas appear in the inspection plans for EMIs only starting in 2021.

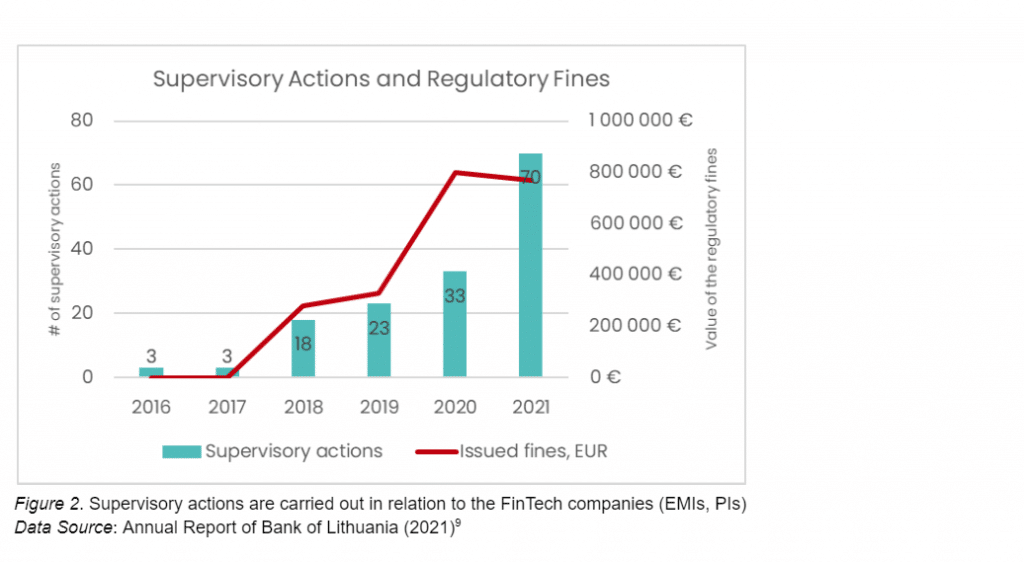

Over the years, the number of inspections, ad-hoc requests and visits carried out by the Bank of Lithuania grew significantly year on year. So did the imposed fines up until 2020 (see Figure 2).

Worth noting that even though the Bank of Lithuania performed two times more analyses, inspections and visits in 2021 compared to 2020, the amount of imposed regulatory fines slightly decreased. These figures could be a proof of market maturity: despite an increasing number of inspections, fewer firms are being fined by the regulator or the imposed fines are smaller in monetary value which could also mean that violations are not that harsh.

Paynt observed that during the last years, the Bank of Lithuania mainly punished firms for compliance with deficiencies rather than non-compliance (*10). As it is visible in the Bank of Lithuania website’s section Enforcement Measures, those firms that were not compliant with the applicable regulations, on many occasions had their licenses revoked or suspended.

It is worth noting that within strengthening FinTech compliance maturity, the barriers to entering the Lithuanian-regulated financial market increase as well. Each year regulation becomes more detailed and regulatory expectations will only rise in the upcoming years. There are also such regulatory bodies as Financial Crimes Investigation Service, State Data Protection Inspectorate, State Tax Inspectorate and others that have their own issued requirements, rules, and decisions that are applicable to FinTech market participants and play a significant role in protecting the financial environment in the Republic of Lithuania.

In the current era of globalization and digitalization, regulated sectors by their nature are becoming more complex each year – within innovative products, the risk of their abuse by offenders is only increasing. Criminals keep searching for new, more sophisticated methods to launder illicit funds, finance terrorism, evade sanctions and otherwise abuse the financial system. Therefore, it is important that market participants have sufficient knowledge and understanding of the existing typologies and emerging risks in order to control them effectively and not become a victim of bad actors.

To conclude, it is evident that Lithuanian regulators consistently seek to improve compliance and drive the FinTech market towards maturity by strengthening and expanding the scope of the applicable regulations. Even though some may see it as a market entrance barrier, it is worth noting that detailed regulation and clear regulatory expectations may be valuable guidance on how to build a sound compliance and risk management program within a business and actually be ready to operate in this complex environment.

Egle Andzeviciute, our Chief Compliance Officer and MLRO, has 8+ years of financial sector experience, an MSc in Financial Economics, and is ACAMS certified Anti-Money Laundering (CAMS) and Global Sanctions Specialist (CGSS). Since joining Paynt she has successfully led the AML/CFT & Compliance team ensuring best practice in an evolving regulatory environment. Her motto, “The risk is too high until one researches, calculates, and understands the unknown”, guides her through the daily challenges.

* Sources:

1) Electronic Money Institutions.TheBanks.EU. URL: https://thebanks.eu/emis

2) Overview of activities of electronic money institutions (EMI) and payment institutions (PI) in Q3 2022. Bank of Lithuania. https://www.lb.lt/uploads/publications/docs/39355_353e60f17d69b60f1c19383f1ebf9fc2.pdf

3) The Fintech Landscape in Lithuania 2021-2022. Invest Lithuania. URL: https://investlithuania.com/report/fintech-report-2021-2022/

4) Annual report (2021), Bank of Lithuania. URL: https://www.lb.lt/lt/leidiniai/metu-ataskaita-2021-m?html=1#_Toc100323511

5) Overview of activities of electronic money institutions (EMI) and payment institutions (PI) in 2022 III quarter. Bank of Lithuania. https://www.lb.lt/uploads/publications/docs/39355_353e60f17d69b60f1c19383f1ebf9fc2.pdf

6) Timeline – The EU-UK withdrawal agreement (2022). Council of the European Union. https://www.consilium.europa.eu/en/policies/eu-relations-with-the-united-kingdom/the-eu-uk-withdrawal-agreement/timeline-eu-uk-withdrawal-agreement/

7) EBA informs customers of UK financial institutions about the end of the Brexit transition period (2020). European Banking Authority. URL https://www.eba.europa.eu/eba-informs-customers-uk-financial-institutions-about-end-brexit-transition-period

8) Inspection plan of financial market participants (2023). Bank of Lithuania. URL: https://www.lb.lt/lt/finansu-rinku-dalyviu-tikrinimo-planas

9) Annual report (2021), Bank of Lithuania. URL: https://www.lb.lt/lt/leidiniai/metu-ataskaita-2021-m?html=1#_Toc100323511

10) Enforcement measures, Bank of Lithuania. URL: https://www.lb.lt/en/enforcement-measures-1